This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

by Rutger de Roo van Alderwerelt

In exploring topics for my MSc thesis in Financial Economics, I came across the concept of a Wellbeing Economy. With my primary academic focus on the economic impact of foreign direct investment (FDI) in international financial markets, I found few academic articles that relate this field to conceptualising a Wellbeing Economy. This offered a valuable research opportunity with a relatively untouched academic focus for my thesis.

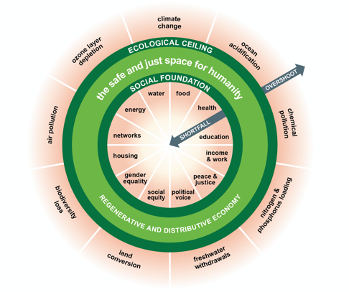

In my preliminary research about economic wellbeing, I was inspired by a book by Kate Raworth, Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist. She illustrates a comprehensive economic model based on the principles of the United Nation’s (UN) Sustainable Development Goals (SDGs). It exemplifies new economic thought that is based on human and ecological wellbeing, which could translate into a Wellbeing economy.

Based on this model, I derived my research question: “Are the United Nation’s Sustainable Development Goals a comprehensive guideline to conceptualise a Wellbeing Economy?”, relating it to the academic field of FDI’s economic impact in international financial markets.

The SDGs and the International Financial Market

FDI is highlighted by the Organisation of Economic Cooperation and Development (OECD) as a significant driver of the achievability of the SDGs.

One particular source of FDI that has been on the rise since 2007 is the social impact investment market. Investors in this market invest their capital, primarily in developing countries and emerging markets, with the aim of generating positive social and environmental impact, along with financial returns. In theory, the existence of this investor sentiment could capture the principles of social justice on a healthy planet in international financial markets.

In practice, the existence of this investor sentiment is illustrated by the global social impact investment market value of $502 billion in 2019. While this is promising, the OECD estimates that a global market value of $4 – 5 trillion is needed to completely achieve the SDGs.

To further increase the size of the social impact investment market in international financial markets, I propose and discuss the following vital objectives in my research:

- Sharing data and conducting case studies on existing impact investment portfolios,

- Develop and promote reliable methodologies in impact measurement and analysis.

Case Study: The Dutch Good Growth Fund (DGGF)

My thesis research dove into the investment portfolio of the Dutch Good Growth Fund (DGGF), which is managed by impact investor, Triple Jump. They invest in small to medium enterprises (SMEs), to improve local economic conditions and create employment opportunities among several demographics; total, female and youth employment.

My quantitative analysis found that:

- Over time, the DGGF has become increasingly effective in positively affecting all three employment objectives in local economies, directly contributing to SDG 8, Decent Work and Economic Growth.

- There may also be indirect effects on the achievement of other SDGs: creating jobs in the formal sector should ensure a decent income for the local population, SDG 1, which may support reduction in hunger, SDG 2 and access to better healthcare and clean water/sanitation, SDG 3 and SDG 6. Furthermore, creating jobs for younger generations and the female population contributes to reduced inequalities, SDG 5 and SDG 10.

The interconnectedness of the SDGs is ever more apparent.

While my case study contributes to the first objective, more research is needed on the spill-over effects to other SDGs. It is promising that we could help achieve multiple SDGs by providing capital to SMEs in developing countries.

My research has made me a firm believer that the social impact investment market will set an example for the whole international financial market. Financial return can be efficiently and effectively combined with social and environmental returns.

Well on our way…

In addition to the insights derived from my own case – study, there are a number of international networks that frequently publish reports on the developments in the social impact investment market. Their objective is to enhance the development of a more unified framework to measure and analyse impact, relating to my proposed second objective.

The Global Impact Investment Network (GIIN) shows 73% of investors in the social impact investment market recognize the SDGs as a tool to determine target impact objectives and to evaluate their performance. More specifically, in their most recent impact investor survey, as can be seen from Table 1 below, the target impact categories reflect the UN SDGs (which was not the case in the same survey, one year before!).

Overall, this is evidence that investors in the social impact investment market are becoming more determined to achieve the UN SDGs.

| Impact Category | Percentage Targeted |

| Decent Work & Economic Growth (SDG 8) | 71% |

| No Poverty (SDG 1) | 62% |

| Good Health and Wellbeing (SDG 3) | 59% |

| Reduced Inequalities (SDG 10) | 58% |

| Affordable and Clean Energy (SDG 7) | 57% |

| Gender Equality (SDG 5) | 56% |

| Sustainable Cities and Communities (SDG 11) | 55% |

| Climate Action (SDG 13) | 54% |

As long as this trend continues, international financial markets can increasingly support the transition to a wellbeing economy.

More about Rutger:

Due to my experience as a part-time intern at the Dutch Development Bank (FMO), I had the privilege to learn first-hand what role FDI can play in achieving the SDGs. As a result, I learned about the active role that impact investors play in shifting international financial markets to human and ecological wellbeing-centred systems.

Throughout writing my thesis, I kept close contact with social impact performance analysts at Triple Jump, FMO and Oikocredit. I also found many other organisations, in the Netherlands and beyond, making it their life’s work to transform our economic system.

I am glad to be given the opportunity to write this blog to give you, perhaps new, perspectives on sectors and markets committed to transforming the global economic system based on principles of human and ecological wellbeing.

If you are interested to learn more about my research and findings or for a full list of sources on the topic of UN SDG integration into the social impact investment market, please contact me via LinkedIn or E-mail.

the discussion?

Let us know what

you would like

to write about!